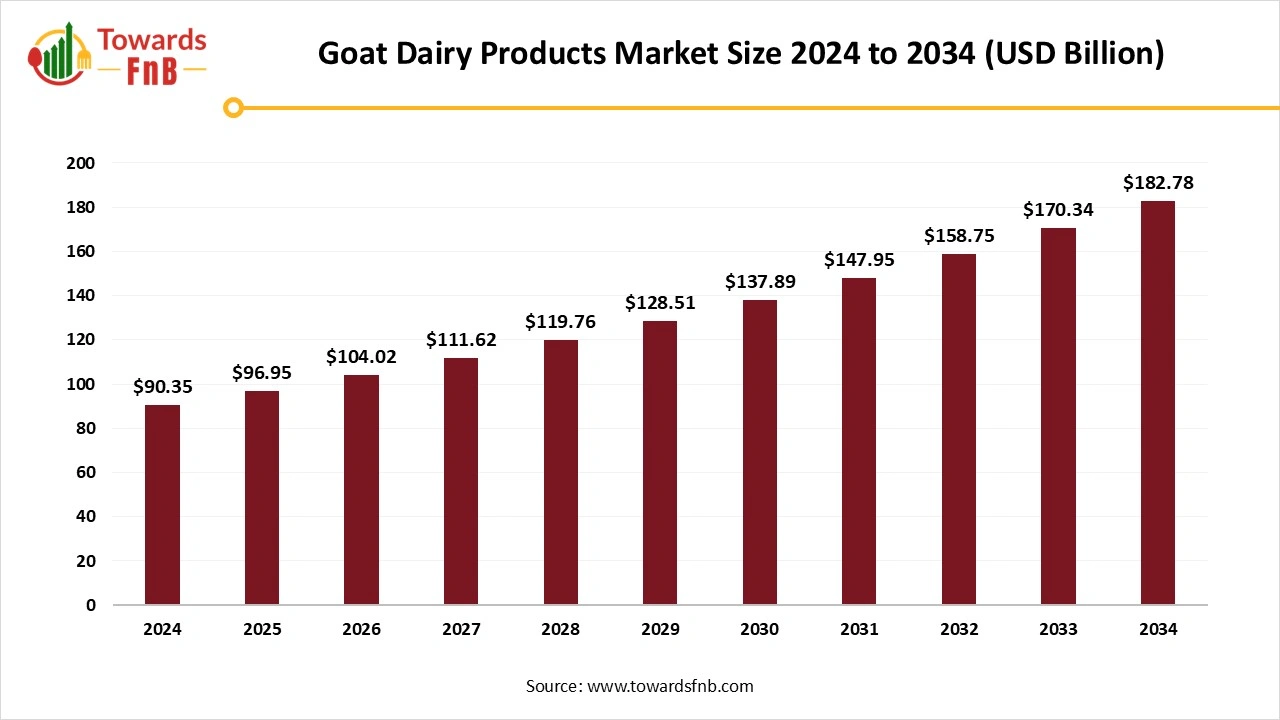

Goat Dairy Products Market Poised to Hit USD 182.78 Billion by 2034, Fueled by Growing Demand for Nutritional and Premium Dairy Options

According to Towards FnB, the global goat dairy products market size is evaluated at USD 96.95 billion in 2025 and is projected to reach USD 182.78 billion by 2034, reflecting at a CAGR of 7.3% from 2025 to 2034. This robust growth underscores the increasing interest in goat milk as a nutritious and versatile alternative to conventional dairy products.

Ottawa, Dec. 12, 2025 (GLOBE NEWSWIRE) -- The global goat dairy products market size stood at USD 90.35 billion in 2024 and is predicted to grow from USD 96.95 billion in 2025 to reach around USD 182.78 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research. The market expansion is being driven by several factors, including the increasing adoption of goat milk across both traditional and emerging markets. Notably, regions such as Asia-Pacific and North America are expected to witness substantial market growth due to shifting consumer preferences towards functional and sustainable food choices.

A key factor fueling this market surge is the growing preference for organic and easily digestible dairy products. Consumers are increasingly seeking goat dairy products for their health benefits, including easier digestion and reduced allergic reactions compared to cow milk. Furthermore, the demand for premium products with unique flavor profiles is rising, as consumers gravitate toward high-quality dairy options that offer both nutritional value and a distinctive taste experience.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5945

Key Highlights of Goat Dairy Products Market

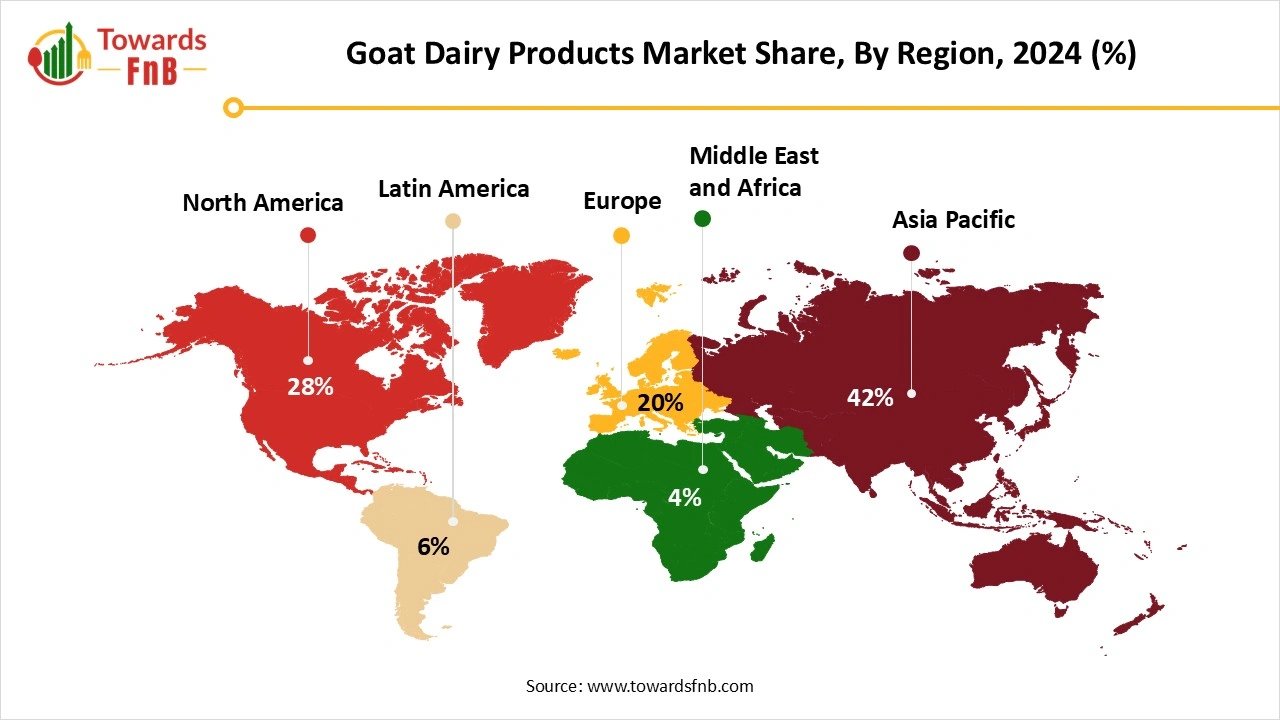

- By region, Asia Pacific led the global goat dairy products market with a 42% share in 2024, while North America is expected to experience the fastest growth during the forecast period. Europe is also expected to grow at a notable rate in the same period.

- By product, the fluid/liquid milk segment held a significant market share of 38.6% in 2024. Meanwhile, the milk powder segment is projected to grow at a CAGR between 2025 and 2034.

- By distribution channel, hypermarkets and supermarkets captured the largest market share, accounting for 38.5% of revenue in 2024. However, online retail/e-commerce is expected to see substantial growth at a CAGR between 2025 and 2034.

- By end use, the general/adult consumers segment led the market with a share of 43.5% in 2024. In contrast, the infant nutrition segment is expected to grow steadily between 2025 and 2034.

High demand for Health-Conscious Options Fueling the Growth of the Goat Dairy Products Industry

The goat dairy products market is expected to grow due to the growing population of health-conscious consumers, rising demand for sustainable and healthier options, and the increasing prevalence of lactose intolerance. The market is also observed to grow as goat milk is healthier and more nutritious, making it an ideal choice for infants and consumers of all age groups. It is easily digestible, making it a perfect choice for people with gut issues.

Dairy products made from goat milk, such as cheese, butter, yogurt, and cream, also help drive market growth. They have a unique flavor profile, further driving market growth. A growing population of health and wellness followers, as well as people with gut issues, prefer dairy options that are easily digestible and less pressurizing on the gut. Hence, such factors also help to fuel the growth of the goat dairy products industry.

Various Domains Helpful for the Growth of the Goat Dairy Products Market

- Food and Nutrition Domain- The food and nutrition segment is one of the major contributors to market growth. Health-conscious consumers today prefer dairy products made from goat milk, such as cheese, butter, and yoghurt. They are highly nutritious and easy to digest, further fueling market growth. Goat milk-based infant formula is also highly sought after, further fueling market growth.

- Cosmetic and Dermatological Industry- Another major industry contributing to the growth of the goat dairy products market is the cosmetic industry. The rich and healthy composition of goat milk, including high protein, fats, and vitamins, makes it an ideal ingredient for the manufacture of skin care and hair care products. Lactic acid is highly nourishing for the skin and helpful for various skin conditions, such as eczema and psoriasis.

-

Pharmaceutical and Health Industry- Goat milk consists of a high amount of bioactive compounds, such as peptides and oligosaccharides, which have potential therapeutic applications. It also contains a high level of antioxidants, antimicrobials, and anti-cancer properties, further fueling the market's growth. It is also an ideal option for athletes who are always on the lookout for high-protein, easily digestible options.

New Trends in the Goat Dairy Products Market

- The growing population of lactose intolerant individuals and consumers with digestive issues is a major factor driving market growth.

- Higher demand for clean-label, organic, and sustainable options with lower environmental impact is another major factor for the growth of the market.

- Higher demand for goat-milk-based infant formulas is another major factor for the growth of the goat dairy products industry.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/goat-dairy-products-market

Recent Developments in the Goat Dairy Products Market

- In July 2025, Soignon, a French cheese brand, announced the launch of its new Triple Cream Goat Brie. The rich, luxurious cheese is designed for the discerning palate in the US market.

- In February 2025, Kabrits, a leading goat milk nutrition provider, announced the launch of its goat milk-based infant formula for babies between 0 and 12 months. It is the first infant formula to receive approval from Health Canada.

Product Survey of the Goat Dairy Products Market

| Product Category | Description or Function | Common Forms or Variants | Key Applications or Consumer Segments | Representative Producers or Brands |

| Fresh Goat Milk | Fluid milk from goats with smaller fat globules and easier digestibility. | Whole goat milk, low fat goat milk, organic goat milk | Household drinking, café beverages, pediatric use where tolerated | Meyenberg, Summerhill Goat Milk, Woolwich Dairy |

| Goat Milk Powder | Spray dried goat milk used for extended shelf life applications. | Whole goat milk powder, skim goat milk powder, infant grade powder | Infant nutrition, baking, recombined milk | Dairy Goat Co operative NZ, AusGoat |

| Goat Cheese (Chèvre) | Soft, tangy cheese made from goat milk. | Fresh chèvre logs, flavored chèvre, whipped goat cheese | Salads, spreads, gourmet foodservice | LaClare Creamery, Vermont Creamery |

| Aged Goat Cheese | Hard or semi hard cheeses aged for deeper flavor. | Aged chèvre, gouda style goat cheese, cheddar style goat cheese | Gourmet retail, cheeseboards, specialty restaurants | Cypress Grove, Belle Chevre |

| Goat Yogurt | Fermented goat milk with smooth to slightly tart profile. | Plain yogurt, flavored yogurt, Greek style goat yogurt | Breakfast, digestive health | Redwood Hill Farm Goat Yogurt, Delamere Dairy |

| Goat Kefir | Fermented goat milk beverage with probiotic properties. | Plain kefir, fruit flavored kefir | Gut health consumers, fermented beverage buyers | Redwood Hill Farm Kefir, small artisanal kefir brands |

| Goat Butter | Butter produced from goat cream with a whiter appearance and mild tang. | Salted goat butter, unsalted goat butter, organic goat butter | Baking, spreading, premium dairy | Meyenberg Goat Butter, European artisanal producers |

| Goat Cream and Half and Half | Cream derived from goat milk used for cooking and specialty beverages. | Heavy cream, light cream, half and half | Sauces, coffee, specialty food manufacturing | Regional goat creameries |

| Goat Ice Cream and Frozen Desserts | Frozen products made using goat milk for lactose sensitive consumers. | Plain goat ice cream, cardamom goat ice cream, chocolate goat ice cream | Premium retail, gourmet dessert markets | Laloo’s Goat Milk Ice Cream |

| Goat Milk Based Infant Formula | Infant formula systems developed using goat milk as the base protein. | Goat whey formula, lactose adjusted goat formula | Infant nutrition segment | Kendamil Goat, Bubs Goat Formula |

| Ultra Filtered and High Protein Goat Milk Products | Goat milk concentrated through filtration for higher protein. | High protein goat milk drinks, goat milk concentrates | Sports nutrition, specialized diets | Niche dairy processors |

| Goat Milk Based Nutraceutical Ingredients | Functional ingredients derived from goat milk. | Goat colostrum powder, goat whey proteins | Supplements, functional foods | Colostrum suppliers, goat whey processors |

| Goat Milk Soap and Cosmetic Products | Goat milk used in topical formulations for skin moisturization. | Goat milk soap bars, lotions, creams | Natural skincare buyers, sensitive skin users | Bend Soap Company, Dionis Goat Milk Skincare |

| Goat Ghee | Clarified goat butter used in specialty cuisines and wellness markets. | Traditional goat ghee, organic goat ghee | Culinary use, Ayurvedic markets | Regional artisanal producers |

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5945

Goat Dairy Products Market Dynamics

What are the Growth Drivers of Goat Dairy Products Market?

Higher demand for healthier, more nutritious options, rising digestive and gut issues, product diversification and versatility, and infant nutrition are some of the major factors driving market growth. Health-conscious consumers in search of high-protein, vitamin, and mineral options also help fuel the market’s growth. In some regions, consumers prefer goat-based infant formula, further fueling the market’s growth in the foreseen period. Goat milk has fewer allergens than cow or buffalo milk and is therefore highly preferred by consumers concerned about health and nutrition, further fueling the market's growth.

Challenge

Production and Supply Issues hampering the Market’s Growth

The requirement for more goats to produce the same quantity of milk as cows to meet consumer demand leads to higher costs. Hence, such issues may hamper market growth. Goat milk is highly perishable compared to other forms of milk and is available with fewer distributors, further obstructing the market’s growth. Managing nutrition and hygiene at scale is also an issue affecting the market’s growth.

Opportunities

Higher demand for Functional and organic options is helpful to the fuel market’s Growth

Goat’s milk is high in essential nutrients such as protein, vitamins, and minerals, making it beneficial for infants and kids and fueling market growth. It contains fewer allergens than cow’s milk and is easily digestible. Hence, it is highly preferred by consumers concerned about health and nutrition, and consumers facing digestive issues. Such issues collectively help fuel the market's growth over the forecast period.

Goat Dairy Products Market Regional Analysis

Asia Pacific dominated the Goat Dairy Products Market in 2024

Asia Pacific dominated the goat dairy products market in 2024, driven by higher demand for healthier, more easily digestible alternatives. Product innovation and versatility, in the form of goat milk-based cheese, butter, and yoghurt, further fuel the market's growth. Factors such as rising disposable income, a growing middle-class population, higher demand for premium options, and higher demand for healthier options are another set of factors that are helpful for the growth of the market. Countries such as India, China, Japan, and South Korea have made a major contribution to the region's market growth due to higher demand for functional and fortified options.

North America is Observed to Grow in the Foreseen Period

North America is expected to be the fastest-growing region over the forecast period due to the easy availability of goat milk-based products across various retail and online platforms. Increasing awareness of the nutritional benefits of goat milk and related products is another major factor driving market growth in the foreseeable future. Goat milk is easily digestible, has fewer allergens, and is therefore highly demanded by consumers with gut issues. The US has a major contribution to the market's growth due to higher demand for healthier, sustainable options.

Europe is observed to have a Notable Growth in the Foreseen Period

Europe is expected to show notable growth over the forecast period due to higher demand for nutritious, sustainable, organic, functional, and fortified options, thereby fueling market growth. The growing population of health-conscious consumers and those with gut issues is another major factor driving the market’s growth in the foreseeable future. The UK, France, and Germany have made major contributions to the market's growth in the region due to higher demand for nutritious options with functional properties.

Trade Analysis for the Goat Dairy Products Market

What is actually traded (product forms)

- Fresh or chilled goat milk and cream shipped in bulk or in consumer packs, typically cleared under national milk HS codes where goat milk is reported within general milk headings.

- Powdered goat milk and goat-milk infant formula in retail cartons and drums; commonly declared under HS 1901 for infant formula and under processed milk powder lines where countries disaggregate by species.

- Goat cheeses and curd, from soft fresh chevres to aged varieties, recorded under HS 0406. These are a major tradable category for European suppliers.

- Fermented goat dairy and yoghurt preparations for retail and foodservice, often classified under general dairy preparations HS 2105 or under cheese and other dairy product headings depending on composition.

Top Exporters (supply hubs)

- France: large producer and exporter of goat cheeses and processed goat dairy, with substantial EU intra-trade volumes into Germany, Belgium and the United Kingdom.

- Spain and the Netherlands: notable EU exporters of goat cheese and specialty goat dairy, supported by concentrated processing and trade logistics.

- India, Pakistan and Bangladesh: major producers of raw goat milk and growing suppliers of bulk goat-milk ingredients for regional markets and for some value-added exports. National production scale supports domestic processing and targeted exports.

- New exporters in specialised segments: small quantities of powdered goat milk and formula are exported from the Netherlands and New Zealand where contract manufacturing and packaging for infant-formula brands take place.

Top Importers (demand centres)

- European Union markets: demand for goat cheese and speciality goat dairy remains concentrated in France, Germany, the Netherlands and southern EU markets for both retail and industrial uses.

- China and East Asia: rising importer of infant formulas and premium dairy ingredients; select goat-milk formulas have established export pathways into China and Hong Kong.

- United States and Canada: importers of speciality goat cheeses and niche goat-milk powders for artisanal and foodservice channels.

- Middle East and Gulf states: importers of consumer-packed goat cheeses and powdered goat-milk specialty items for expatriate and premium retail segments.

Typical Trade Flows and Logistics Patterns

- EU intra-region flows: large volumes of goat cheese move within the EU by road and short-sea shipping from production regions to processing and retail centres.

- Powdered formula routes: powdered goat-milk infant formula and speciality powders are often manufactured or packaged in the Netherlands or New Zealand and containerised for long-distance shipment to East Asia and the Middle East. Many shipments clear under infant-formula or milk-powder tariff lines.

- Bulk-repacking hubs: ports with co-packing facilities rebag goat-milk powder into retail containers for brand owners, creating re-export patterns from packaging hubs.

- Live-culture or refrigerated dairy flows are limited because many goat dairy commodities are shelf-stable powders or aged cheeses; temperature considerations focus on chilled cheese carriage and storage at destination.

Trade Drivers and Structural Factors

- Production geography: small-ruminant dairy is concentrated in parts of South Asia, North Africa and Europe. Large goat populations in India, Sudan and Pakistan underpin raw-milk supply.

- Infant-formula premiumisation: demand for goat-based infant formulas in parts of Asia creates high-value export opportunities for certified powder producers.

- Gastronomy and premium consumer trends: growth in artisan cheeses and foodservice demand supports cross-border trade in goat cheeses.

- Regulatory and sanitary requirements: strict infant-formula and dairy safety rules in importing markets increase compliance costs and favour certified exporters.

-

Logistics and packaging capabilities: availability of hygienic powder-handling, specialised packaging and certified co-packers determines which origins can serve distant markets.

Regulatory, Quality and Market-Access Considerations

- Infant-formula regulation: goat-milk formulas face the same pre-market approval, compositional and labelling requirements as cow-milk formulas in many markets. Exporters must maintain registration and submit formula dossiers where required. (Source: national food regulation guidance)

- Dairy safety testing: contaminants, microbiological limits, antibiotic-residue testing and shelf-life validation are standard pre-shipment controls. Certificates of analysis are commonly required.

- HS classification and species declaration: many customs systems do not disaggregate milk by species clearly. Exporters should confirm the applicable HS lines and any product-specific declaration required by the importer.

- Geographical indications and protected names: some goat cheeses have protected status in origin markets which affects labeling and market access.

Government Initiatives and Public-Policy Influences

-

Rural-dairy support programs: in major producing countries, extension services, breed-improvement and milk-collection centre investment raise raw-milk yields that feed processing and export opportunities.

- Food-safety and export facilitation: trade promotion agencies and sanitary capacity building support listing of export establishments for formula and dairy processors in target markets.

-

Import controls in sensitive segments: some importers apply tight registration or tendering rules for infant formula and restrict new suppliers until approvals are granted.

Goat Dairy Products Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 7.3% |

| Market Size in 2025 | USD 96.95 Billion |

| Market Size in 2026 | USD 104.02 Billion |

| Market Size by 2034 | USD 182.78 Billion |

| Dominated Region | Asia Pacific |

| Fastest Growing Region | North America |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Goat Dairy Products Market Segmental Analysis

Product Analysis

The fluid/liquid milk segment dominated the goat dairy products market in 2024, driven by higher demand and convenience, allowing a large number of consumers to opt for this form. The market also sees growth, as goat milk is nourishing and nutritious, with a unique flavor profile. It also serves as a base for manufacturing multiple dairy-based options and has a high demand among consumers in their dairy diets. Hence, such factors collectively help fuel the market's growth.

The milk powder segment is expected to be the fastest-growing in the forecast period due to its versatility, useful for manufacturing a range of dairy-based products, thereby fueling market growth. The extended shelf life of the products also helps fuel the market’s growth, as it allows consumers to store the products with ease and use them as per their requirements. The market also shows growth driven by high demand for its nutritional, functional, and organic properties.

Distribution Channel Analysis

The supermarkets/hypermarkets segment dominated the goat dairy products market in 2024, owing to the easy availability of these stores near residential areas, which made it easy for consumers to shop for the required options. The market also observes growth as such stores have separate sections for various products, allowing consumers to shop for their desired products with ease. Hence, it allows consumers to choose their desired products with ease, which is beneficial for market growth.

The online retail platform segment is expected to grow over the forecast period due to the convenience it provides, which is beneficial for the market’s growth. Such platforms have a vast product portfolio, making it easy for both new and regular consumers to shop for the right product. The availability of attractive discounts and price deals is another helpful factor in the growth of the goat dairy products market. Easy delivery of products to homes within a few minutes is highly preferred by consumers with hectic lifestyles, which is helpful for the growth of the goat dairy products industry.

By End Use Analysis

The general/adult consumers segment led the goat dairy products market in 2024, due to the growing population of consumers focused on health and nutrition. The segment also observes growth driven by rising disposable income, rapid urbanization, and higher demand for healthier, more easily digestible options. Goat milk and its byproducts are also in demand among consumers with gut issues, as they are easily digestible, helping to fuel the market’s growth.

The infant nutrition segment is expected to grow over the forecast period, as goat milk and its related products are highly nutritious and rich in essential nutrients such as protein, vitamins, and minerals. Goat milk has fewer allergens and is easy to digest compared to cow or buffalo milk. It makes it ideal for infants to consume goat milk-based options, further fueling market growth in the foreseeable future.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Dietary Supplements Market: The dietary supplements market size is projected to reach USD 464.58 billion by 2034, growing from USD 192.68 billion in 2025, at a CAGR of 9.2% from 2025 to 2034.

- Frozen Food Market: The global frozen food market size is expected to grow from USD 214.32 billion in 2025 to reach around USD 347.01 billion by 2034, at a CAGR of 5.5% over the forecast period from 2025 to 2034.

- Vegan Food Market: The global vegan food market size is evaluated at USD 22.38 billion in 2025 and is expected to reach USD 55.88 billion by 2034, with a CAGR of 10.7% during the forecast period from 2025 to 2034.

- Sugar-Free Food Market: The global sugar-free food market size is expected to grow from USD 48.14 billion in 2025 to USD 83.2 billion by 2034, growing at a CAGR of 6.27% during the forecast period from 2025 to 2034.

- Food Additives Market: The global food additives market size is rising from USD 128.14 billion in 2025 to USD 214.66 billion by 2034. This projected expansion reflects a CAGR of 5.9% throughout the forecast period from 2025 to 2034.

- Ethnic Food Market: The global ethnic food market size is forecasted to expand from USD 93.47 billion in 2025 to reach around USD 179.21 billion by 2034, growing at a CAGR of 7.5% during the forecast period from 2025 to 2034.

- Meal Kits Market: The global meal kits market size is projected to rise from USD 17.11 billion in 2025 to approximately USD 58.8 billion by 2034, registering a CAGR of 14.7% during the forecast period from 2025 to 2034.

- Baking Ingredients Market: The global baking ingredients market size is projected to grow from USD 18 billion in 2025 to around USD 31.72 billion by 2034, at a CAGR of 6.5% during the forecast period from 2025 to 2034.

- Fresh Produce Market: The global fresh produce market size is projected to grow from USD 3,707 billion in 2025 to approximately USD 5,653 billion by 2034. This anticipated growth represents a CAGR of 4.80% during the forecast period from 2025 to 2034.

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

-

Organic Food Market: The global organic food market size is expected to grow from USD 253.96 billion in 2025 to USD 660.25 billion by 2034, with a compound annual growth rate (CAGR) of 11.20% during the forecast period from 2025 to 2034.

Top Companies in the Goat Dairy Products Market

- Goat Partners International Inc: Goat Partners International is a leading provider of premium goat dairy products, including milk, cheese, and powder. The company focuses on sustainable production methods and caters to both consumer and B2B markets globally.

- St Helen's Farm Ltd: St Helen’s Farm is a UK-based producer of high-quality goat dairy products, including milk, cheese, and yogurt. The company emphasizes organic farming and is a key player in the European goat dairy market.

- Woolwich Dairy Inc: Woolwich Dairy, based in Canada, specializes in artisanal goat cheeses, including soft and aged varieties. The company is known for its high-quality products and sustainability practices in the North American market.

- Xi'an Baiyue Goat Dairy Group Co., Ltd.: A leading Chinese producer, Xi'an Baiyue offers goat milk-based products, including milk powder and infant formula. The company is expanding its presence in the growing Asian market for functional dairy products.

- Meyenberg Goat Milk Products: Meyenberg is a well-known U.S. brand offering goat milk products like fluid milk and cheese. Known for its premium quality, Meyenberg caters to health-conscious consumers seeking lactose-free dairy alternatives.

- Redwood Hill Farm & Creamery: Redwood Hill Farm, based in California, specializes in organic goat milk products, including cheese, yogurt, and milk. The company is dedicated to sustainable farming and creating high-quality dairy alternatives.

- Saputo Inc.: Saputo, a global dairy leader, offers a range of goat dairy products through brands like Shepherd’s Way and La Sauvagine. Known for its global scale, Saputo focuses on producing premium goat dairy options.

- Dairy Goat Cooperative NZ Ltd: This New Zealand-based cooperative produces high-quality goat milk, milk powders, and infant formula. Dairy Goat Cooperative is the largest in the country, focusing on sustainable practices and international markets.

- Delamere Dairy: Delamere Dairy, located in the UK, produces a variety of goat milk products such as cheese, yogurt, and milk. Known for its quality, the company targets health-conscious consumers seeking easy-to-digest dairy options.

- HiPP GmbH & Co. Vertrieb KG: HiPP, a German company, is renowned for its organic baby food, including goat milk-based infant formulas. The company is a trusted name for high-quality, organic dairy products for babies.

- GRANAROLO S.p.A.: GRANAROLO, an Italian dairy giant, offers goat milk products such as cheeses and milk. The company is committed to quality and sustainable farming practices, particularly in the European market.

- AVH Dairy Trade B.V.: AVH Dairy Trade, based in the Netherlands, specializes in the global trade of dairy products, including goat milk powder and infant formula. The company focuses on international distribution and supply chain expertise.

Segments Covered in the Report

By Product Type

- Fluid / Liquid Milk

- Milk Powder (Full-cream, Skimmed)

- Cheese (Fresh, Aged, Soft, Semi-hard, Specialty)

- Yogurt & Fermented Goat Milk Products

- Infant Milk Formula & Growing-up Milk

- Butter & Cream Products

- Other Dairy Products (Ice-cream, Whey, Nutritional Supplements)

By Distribution Channel

- Hypermarkets / Supermarkets

- Convenience Stores

- Specialty Stores / Health Food Stores

- Online Retail / E-commerce

- Direct B2B (Foodservice, Institutional)

By End-User / Application

- General / Adult Consumers (household consumption)

- Infant Nutrition (formula, powdered milk)

- Elderly / Special Nutrition (e.g. easy digestibility)

- Retail & Foodservice (restaurants, cafes)

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5945

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

➡️Fish Oil Market: https://www.towardsfnb.com/insights/fish-oil-market

➡️Soft Drink Concentrates Market: https://www.towardsfnb.com/insights/soft-drink-concentrates-market

➡️Coffee Beans Market: https://www.towardsfnb.com/insights/coffee-beans-market

➡️Soybean Market: https://www.towardsfnb.com/insights/soybean-market

➡️Beef Market: https://www.towardsfnb.com/insights/beef-market

➡️Cheese Market: https://www.towardsfnb.com/insights/cheese-market

➡️Food Packaging Market: https://www.towardsfnb.com/insights/food-packaging-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.